Omiete Joseph

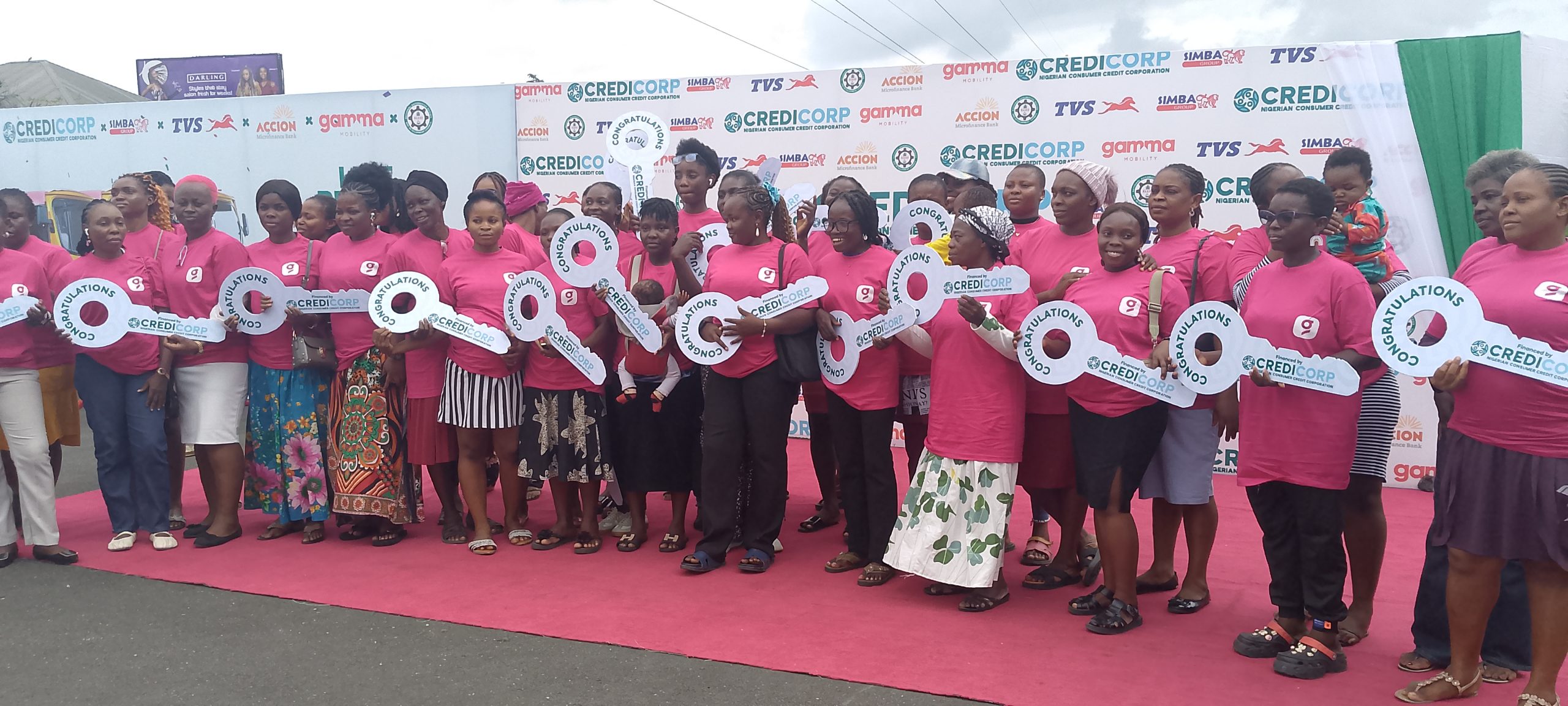

It was celebration today in Port Harcourt, when some women in the State received tricycles and other business support from the Nigerian Consumer Credit Corporation (CREDICORP).

CREDICORP, a federal government agency with Gamma Mobility, rolled out expansion of the Queen Rider program, an ambitious nationwide initiative empowering 3,700 Nigerian women to become tricycle owners and operators through access to credit-backed vehicle purchases.

This rollout was classified under CREDICORP’s S.C.A.L.E. program (Securing Consumer Access for Local Enterprises) which links everyday consumers to Nigeria’s manufacturing backbone.

In this stance, CREDICORP is channeling credit-backed women toward purchase of locally assembled tricycles from Simba TVS, which produces 1,170 tricycles and motorbikes daily in Nigeria.

But this is more than just mobility. It’s a strategy for economic inclusion, putting working tools in the hands of women who are too often locked out of high opportunity sectors like urban transportation.

With partner financial institutions such as Accion Microfinance Bank, CREDICORP is scaling access to productive assets that improve household incomes, stimulate local manufacturing, and unlock the economic power of Nigerian women.

Speaking at the rollout of the programme in Port Harcourt, Managing Director of CREDICORP, Engr Uzoma Nwagba, said the Queen Rider initiative is part of agency’s wider effort to support half of Nigeria’s working population by 2030 with consumer credit tools that directly enhance their quality of life, whether through vehicle ownership, clean energy adoption, or youth enterprise.

Nwagba attributed the initiative to President Bola Tinubu’s desire for Nigerians to own credit power, stressing that with the scheme, the citizens do not need to work till retirement before owning homes and other essentials that makes life comfortable.

“This initiative is President Bola Tinubu’s mandate. He is a man who is very passionate about consumer credits for many decades and it is his idea that people should be able to access goods and services today and better their lives and pay for it overtime.

“He said we should have a credit system that works for all. Civil servants don’t have to wait until retirement to own a house or have a car. They should be able to get it at the beginning of their service and same with non-civil servants, salary workers, entrepreneurs, artisans. They should be able to get their solar panels, vehicles, renovate their homes through access to credit,” he added.

Nwagba advised the beneficiaries to maximise the empowerment tool to better their lives and also pay back consistently in order not to deny other women from benefitting from the programme.

He also announced that aside from the Queen Rider Programme, the agency is also involved in several other initiatives such as electronic devices to enable young people get smartphones and laptops to be able to get on the digital economy and be more productive.

The CREDICORP boss called on Nigerians to get used to consumer credits to enable them become productive users of credit, adding that consistency in repayment guarantees more credits.

Also speaking, Co-Founder of Gamma Mobility, Sam Esiri, said the programme is poised to ignite dignity, purpose and prosperity for thousands of Nigerian women.

He explained that the Queen Riders Programme is not just a product launch, but a resolute proclamation that Nigerian women deserves unhindered access to the tools of economic empowerment.

He commended the efforts of CREDICORP and other partners in the scheme.

“This programme entails that mobility must transcend mere movements, it must propel lives towards brighter futures and with the right platforms, women can steer the transformation of urban transport in Nigeria. This bold vision comes to life through the remarkable synergy of our partners whose collective efforts have made this moments possible,” Esiri stated.

Speaking on the benefits of the programme, Esiri said through the Queen Riders Programme, the women would own their vehicles, own their income, forge sustainable livelihoods and also own their futures by becoming independent.

A beneficiary of the programme, Mrs Chidimma ThankGod, praised CREDICORP and their partners for putting smiles on their faces. She assured that they (beneficiaries) will maximally utilise the opportunity given to them.